Top 5 Free Alternatives to Notion That Work Offline (No Account Needed)

Notion is a strong tool for note-taking and project planning, yet many users face limits with its constant internet connection and account requirements. These restrictions block those who need reliable access in offline situations or users who prioritize privacy and data control.

The demand for free, offline tools without any signup is growing fast. Local storage, open source, and privacy have become must-haves, especially for professionals handling sensitive notes and projects. This post highlights five leading free alternatives that work offline—no accounts, no cloud lock-in, and no hidden costs—so you can stay productive and private wherever you work.

Why Choose an Offline, No-Account Productivity App?

Productivity tools are supposed to help us focus and work without distraction. Yet, most cloud-based note and task apps create new headaches for users. People must trade control and privacy for convenience. Offline, no-account apps put you back in charge, cutting out unnecessary barriers and risks.

Photo by Efrem Efre

Photo by Efrem Efre

Frustrations With Cloud Apps

Many users hit walls with cloud-based tools:

- Always-On Internet Requirement: Your notes become locked behind a login screen if your connection drops.

- Forced Accounts: You must create, verify, and maintain accounts—even if you just want to jot down a quick list.

- Organization Limits: Cloud apps force you to adapt to their workflows, often leading to friction and lost time.

- Sync Errors: Data syncing can break, causing mismatches or lost content.

- Ads and Upsells: Free plans often push unwanted ads or try to force you into paid upgrades.

These issues can slow down your flow and add unnecessary complexity. For real examples and user pain points, read about the problem with cloud-based note-taking apps.

Privacy and Data Ownership

Storing sensitive projects and personal notes on the cloud carries risk. Data stored offsite is out of your control and vulnerable to leaks, breaches, or unexpected access. Many providers set unclear boundaries about who owns your files and how they’re used.

Strong offline tools keep your data local. You never worry about third parties scanning or analyzing your notes. According to Flexential’s overview of cloud data privacy, any data in the cloud can be lost, leaked, or misused—sometimes even by accident.

Ownership is clearer with offline tools. You store files on your device, and you hold the keys. This simple setup avoids the legal gray areas explained in guides about data ownership in cloud computing.

Productivity Benefits

Offline, account-free apps help you work without limits:

- No Logins: Open and start working in seconds—no sign-up, no password resets.

- Instant Access: Use your app anywhere: on a plane, in a basement, or outdoors—no connection, no problem.

- No Hidden Costs: Truly free apps with no monthly or annual bills.

- Reduced Distractions: With no notifications, social features, or ads, you focus on your priorities.

Working this way leads to less frustration and more output—your work, your way, with nothing getting in the middle.

For those who want tools that respect privacy, boost speed, and don’t force you into a cloud-only workflow, offline, no-account apps provide a smarter choice.

Obsidian: Powerful Markdown-Based Note Management

Photo by Thirdman

Photo by Thirdman

Obsidian is a desktop note management app that runs completely offline. It gives you full control over your notes, with no account or cloud sign-up required. Obsidian organizes everything using local folders, not a server. All files stay on your device, so you never lose access or worry about third-party use.

100% Offline Access with Local Storage

Obsidian uses “vaults”—folders on your computer where all your notes are saved as plain text Markdown files. There’s no need for internet access to use the app. You can view, edit, and manage your data whether you’re at home, on a plane, or working anywhere without Wi-Fi.

- All data is local: No uploads, no remote servers.

- Flexible backup: Since your notes are plain files, you can back them up however you want.

For more details, read about how Obsidian is a local-first tool that never forces cloud syncing or remote storage on ToolFinder’s review.

Markdown: Simple and Powerful

Obsidian stores every note as a .md (Markdown) file. Markdown is a lightweight way to format text using easy-to-read symbols. You get fast typing, clear structure, and you can use your favorite plain-text editor outside of Obsidian if needed.

- No file lock-in: Move or convert notes to other tools anytime.

- Open format: You keep your files—nothing hidden or encrypted without your approval.

Vault System for Organization

A vault is just a folder on your device, but Obsidian treats it as a workspace. You can set up:

- Multiple vaults for work, study, or personal projects.

- Custom folder structures to sort by topic, date, or workflow.

- Direct file access: Open your notes in Obsidian or any Markdown-friendly editor.

Plugins for Custom Workflows

Obsidian’s plugin system lets you add features without giving up privacy. The core app has many options built-in, but you can install plugins to add:

- Daily notes with templates

- Kanban boards

- Local search boosters

- Custom styling

All plugins run on your device—they don’t force internet use or account logins.

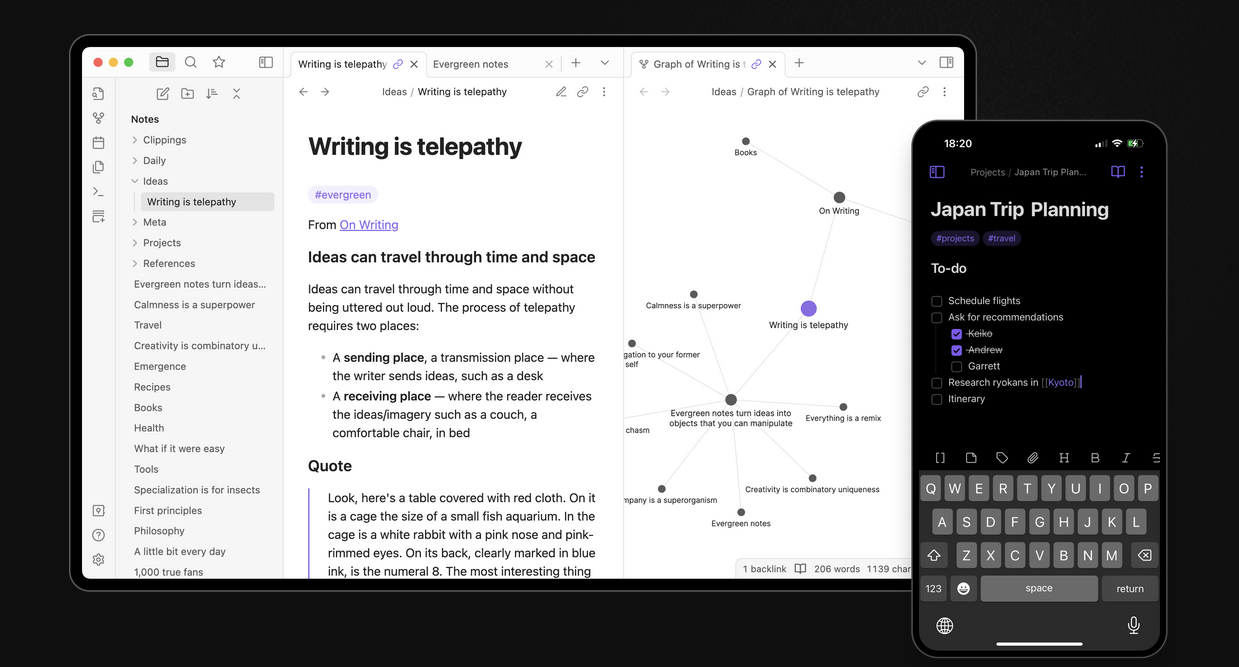

Graph View: See Connections

Obsidian builds a live map of your connected notes—the Graph View. You can spot patterns and links between concepts at a glance. This feature works offline with your files. It gives you a bird’s-eye view of your ideas and how they relate, making it ideal for projects, research, or personal knowledge bases.

Full File Control and No Registration

Obsidian runs after download—no registration or sign-in is ever needed. You won’t be nagged for an email or password. All updates are local. If you want optional sync, that’s available, but it’s never required. Your notes are always yours.

To see a focused discussion on Obsidian’s clean offline approach compared to others, check out the recent insights on Reddit’s ObsidianMD forum.

Obsidian gives you a reliable, account-free, local-first tool that grows with your workflow.